Salesforce Lightning is a modern, streamlined version of Salesforce designed to enhance productivity, usability, and speed. Unlike its predecessor, Salesforce Classic, Lightning offers an intuitive interface, drag-and-drop capabilities, and highly customizable dashboards. This newer interface helps developers create more responsive applications, enabling users to work more efficiently and providing businesses with real-time data insights.

Why Learn Salesforce Lightning Development?

The demand for Salesforce Lightning Development is rapidly growing, with companies transitioning from Salesforce Classic to Lightning. As more businesses recognize the benefits of Lightning’s flexibility, many are turning to Salesforce Lightning Development companies like A-Two Cloud for custom solutions that meet their unique needs. Learning Lightning Development opens up exciting career opportunities and is essential for developers looking to stay relevant in today’s CRM landscape.

Key Components of Salesforce Lightning Development

1.) Lightning App Builder:

A user-friendly tool that enables users to create custom pages without writing code. With drag-and-drop features, even non-developers can configure pages easily.

2.) Lightning Components:

Salesforce Lightning offers reusable building blocks, known as components, that help developers design highly customized applications.

3.) Lightning Design System (SLDS):

This ensures that applications have a consistent and responsive design, creating a unified user experience across devices.

4.) Lightning Experience:

This is the new Salesforce UI, tailored to provide an enhanced user experience with better performance and functionality.

Setting Up Your Salesforce Development Environment

To start with Salesforce Lightning Development, you’ll need to set up your environment:

a.) Create a Salesforce Developer Account:

Start by setting up a free Salesforce developer account.

b.) Install Visual Studio Code:

This powerful code editor, along with Salesforce extensions, will help you manage and deploy code efficiently.

c.) Enable Lightning Experience:

Make sure that you enable Lightning Experience in your Salesforce settings to access all its tools and features.

With these tools in place, you’re ready to begin building.

Building Your First Lightning Component

Let’s walk through the creation of a basic Lightning component:

a.) Define Component Structure:

Lightning components consist of HTML, JavaScript, and Apex (the server-side language).

b.) Set Up Attributes:

Define attributes for your component to store data.

c.) Data Binding:

Use data binding to display data dynamically within your component.

d.) Testing:

Preview your component to ensure it’s functioning as expected within the Salesforce environment.

Creating custom components is fundamental for any Salesforce Lightning Development company to deliver tailored solutions, providing a more seamless and interactive experience for users.

Understanding Apex and SOQL in Lightning Development

Apex is Salesforce’s programming language, and SOQL (Salesforce Object Query Language) is used for querying data. Here’s a quick overview:

a.) Apex:

Used to write custom business logic, like processing records and handling events.

b.) SOQL:

Similar to SQL, SOQL retrieves data from Salesforce’s databases. This is essential when creating applications that need to display user or client data.

Mastering Apex and SOQL is a core part of Salesforce Lightning Development, allowing developers to build dynamic, data-driven applications.

Exploring Lightning App Builder and Customization Options

The Lightning App Builder provides a powerful interface for developers and non-developers alike to customize Salesforce pages. Here’s how it works:

a.) Drag-and-Drop:

Quickly add and arrange components on a page without needing to code.

b.) Page Customization:

Tailor each page for different user profiles or departments.

c.) Flexibility for Developers:

Developers can create custom components that non-developers can later use within the app builder.

A company like A-Two Cloud leverages the Lightning App Builder to build user-friendly interfaces that meet each client’s specific requirements.

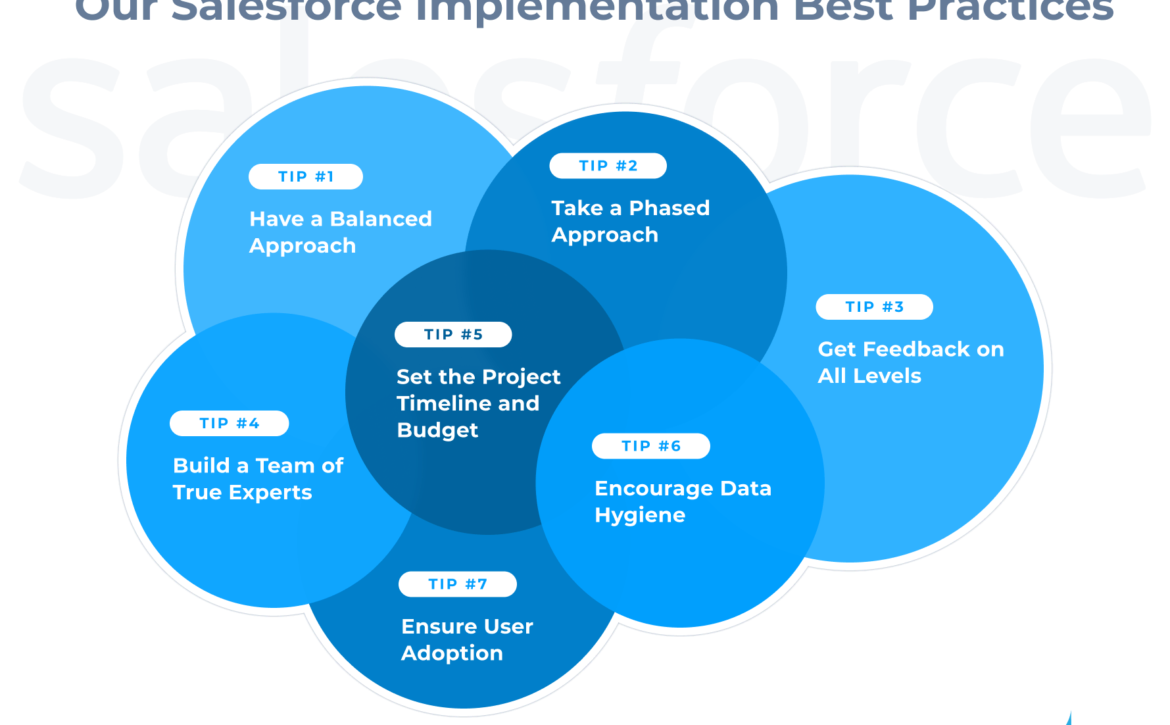

Best Practices for Salesforce Lightning Development

To build effective, scalable applications, follow these best practices:

a.) Optimize Performance:

Ensure components load quickly and data retrieval is efficient.

b.) Structure Components:

Use modular design for ease of maintenance and reusability.

c.) Security Measures:

Implement user permissions and authentication to protect sensitive data.

By adhering to these guidelines, Salesforce Lightning Development services provide robust, secure, and reliable applications that enhance business operations.

Common Challenges and How to Overcome Them

Salesforce Lightning Development can have its challenges, such as:

a.) Debugging:

Using Salesforce’s debugging tools, like the Developer Console, can help.

b.) Data Loading Issues:

Implement pagination and filters to handle large datasets efficiently.

c.) Performance Optimization:

Optimize your Apex code and leverage caching where possible.

A-Two Cloud specializes in overcoming these challenges, ensuring your Salesforce solutions are both effective and user-friendly.

Resources for Continued Learning

To expand your knowledge in Salesforce Lightning Development, explore the following resources:

a.) Salesforce Trailhead:

Free online modules and hands-on challenges for every level.

b.) Official Documentation:

Salesforce’s own documentation is a great reference for any development question.

c.) Developer Communities:

Join forums and online groups to connect with other Salesforce developers.

Conclusion

Salesforce Lightning Development opens up a world of possibilities for creating powerful, user-centric applications. For businesses looking to leverage these capabilities, partnering with a specialized Salesforce Lightning Development company like A-Two Cloud can help you unlock Lightning’s full potential.